Organon provides a number of programs to help you and your family build savings and improve your financial well-being, highlighted by our 401(k) plan with company contributions.

The Organon U.S. Savings Plan is a 401(k) plan through which both you and Organon can contribute to your retirement savings. The plan is designed to help you prepare for a healthy and financially secure retirement.

You are eligible to participate in the Organon U.S. Savings Plan (“401(k) plan”) on your date of hire.

Vesting means you own your account and can take those funds with you if you leave Organon. Vesting in the 401(k) plan occurs in two phases:

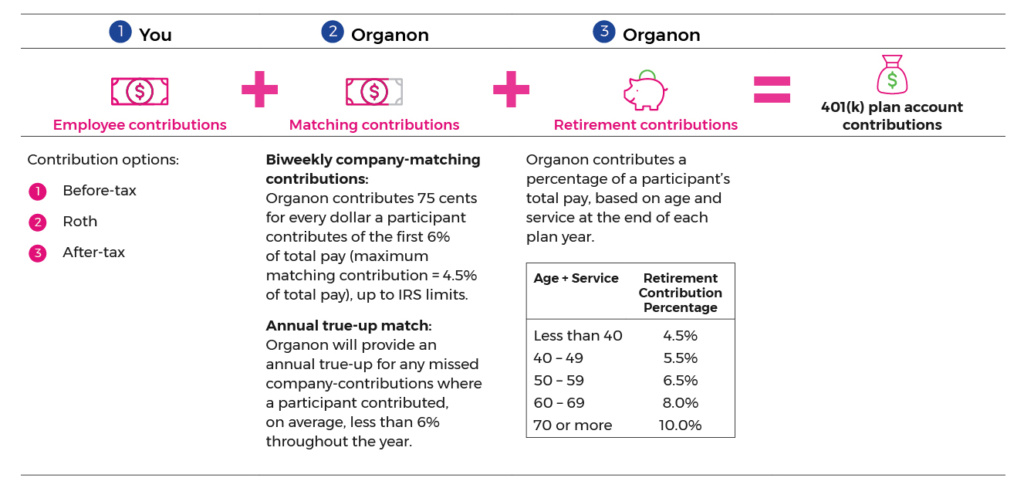

Organon’s matching contributions are made on a per-pay-period basis up to IRS limits, not to exceed 4.5 percent of total pay. Please refer to the graphic above.

Enroll by visiting netbenefits.com. Go to the Organon U.S. Savings Plan and click Enroll or call the Fidelity Benefits Service Center. (New hires: Please allow five business days from your hire date for Fidelity to set up your new hire records.)

You will be automatically enrolled in the 401(k) plan within 60 days of your date of hire (if you have not already enrolled). Here is how your default account will be set up:

It is important that you name your beneficiary(ies) when you enroll in the plan. Your beneficiary receives your vested account balance in the event of your death. If you do not name a beneficiary, distribution of your vested 401(k) plan balance to your heirs may be delayed and your money may not go to your preferred beneficiary. If you are married, your spouse is your default beneficiary. To name or change your beneficiary, log into netbenefits.com.

Reminder: Update your plan beneficiary(ies) if you experience a life event change, such as marriage, divorce, death of a spouse, or birth of a child. Your 401(k) plan beneficiary overrides any beneficiary named in your will or court documents.

Your 401(k) account can be funded in three ways:

|

Before-tax |

Roth |

After-tax |

|---|---|---|

|

|

|

Note: All contributions are subject to annual IRS limits.

Our plan offers a Roth conversion feature that permits you to convert fully-vested funds already in your 401(k) plan account to Roth contributions. This is called an “in-plan Roth conversion.” The advantage is that any earnings earned after the conversion will be tax-free at the time of a qualified distribution.

Speak to a Fidelity Benefits Service Center representative about the pros and cons of in-plan Roth conversions.

The decision to convert needs to be made carefully and should include a consultation with your tax adviser.

You can automatically increase your 401(k) plan employee contribution amount by 1 percent, 2 percent or 3 percent per year until your before-tax base pay and before-tax AIP/SIP contribution rates each reach a maximum of 25 percent. This makes it easy to save a portion of base salary increases toward your retirement.

To automatically increase your annual contribution, visit netbenefits.com or call the Fidelity Benefits Service Center.

The “true-up” feature ensures you receive the full company match (4.5 percent of total pay, up to the IRS compensation limit) regardless of your contribution pattern during the calendar year and if you meet the following criteria:

Our plan also offers a spillover feature, where you may choose to have your before-tax and/or Roth contributions automatically switched to after-tax contributions if you reach the IRS employee contributions limit prior to the end of the year. This allows you to continue to receive the company match by ensuring you continue to make employee contributions each pay period to the plan.

Return of excess contribution: If you contribute more than the IRS employee contribution limit during the plan year (whether at Organon or another employer), you are entitled to a return of the excess contribution amount. You can work directly with Fidelity to process the return.

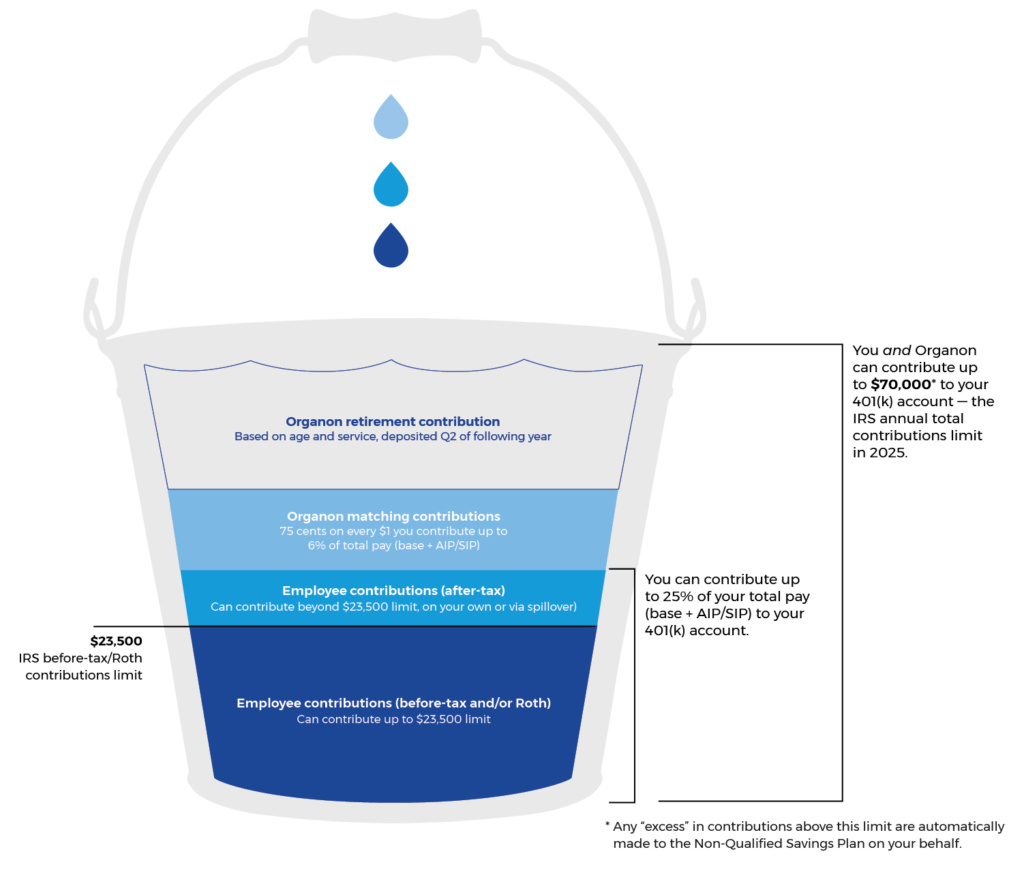

The IRS limits how much you and the company can contribute to your 401(k) plan each year.

|

IRS Limit |

2025 |

||

|---|---|---|---|

|

Compensation limit |

$350,000 |

||

|

Maximum 401(k) elective deferral = 25 percent of eligible pay up to limit (before-tax + Roth contributions) |

$23,500 |

||

|

Total contributions limit = employee contributions except catch-up contributions or rollovers + Organon matching contribution + Organon retirement contribution |

$70,000 |

||

|

Catch up contributions for employees age 50+ by December 31 (available to be made as before-tax or Roth contributions) |

$7,500 |

||

Important: If you contributed to another 401(k) plan before joining Organon in the same year, that amount counts toward your contributions limit for the year. It is your responsibility to track your total contributions when contributing to different 401(k) plans.

How your employee contributions plus company contributions work together can be complicated. Especially with IRS limits. Here’s an overview of how they can add up (start from the bottom and move up).

You can direct the investment of your funds in the 401(k) plan among the plan’s investment options. Please carefully evaluate the risk and return characteristics of each option before making your investment decisions. It is important to diversify your investment elections so that you minimize your risk in case certain investments perform poorly.

The plan offers a three-tiered approach to investing:

|

DO IT FOR ME |

GUIDE ME |

LET ME DO IT |

|---|---|---|

|

Offers retirement portfolios, which are a custom set of target date retirement funds based on your anticipated retirement age. They provide an alternative if you choose not to create an investment mix with individual investment options. They include pre-mixed assets that automatically become more conservative as the fund approaches its target retirement date. |

These are core funds, which are a selection of five investment options — active and passive — that span a range of asset classes. Core fund options include money market, bond, domestic index, and international index funds. |

A self-directed brokerage account that provides access to more than 12,000 mutual funds. |

You can view the exact fund options on netbenefits.com. For help deciding what’s best for you, review Fidelity’s online Planning and Guidance Center, or contact a Fidelity representative.

Note: If you enroll in the plan, but do not elect investment options, your contributions and Organon matching contributions will be invested in the Plan’s Designated Fund — a retirement portfolio based on an assumed retirement at or around age 65.

If you need to withdraw money from your 401(k) plan, you have three options available:

Alternatively, you can choose to leave your 401(k) with Organon until you turn age 65. Certain restrictions and fees may apply.

If you are ready to retire, you can roll over your account to an IRA or elect up to 10 installment payments directly from the plan. Contact the Benefits Service Center for assistance with distributions.

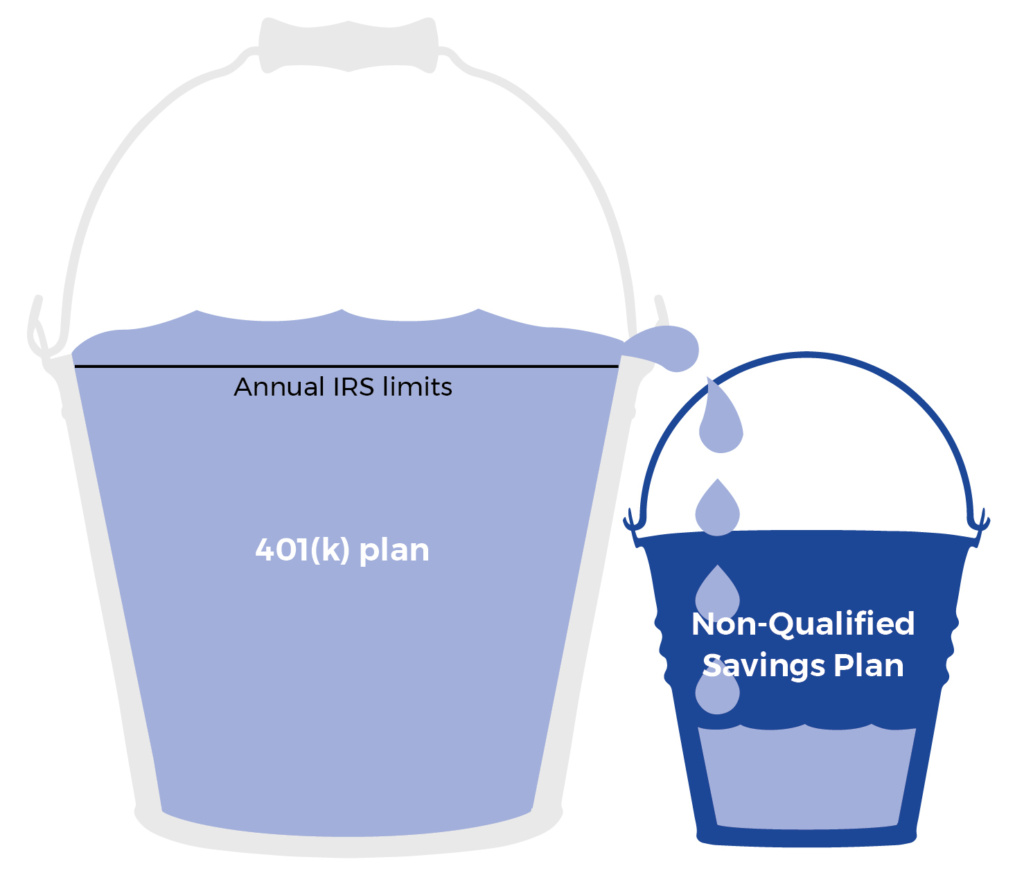

Some founders may be eligible to participate in the Organon U.S. Non-Qualified Savings Plan, a non-qualified plan under federal tax law and IRS regulations and is an additional savings vehicle beyond the 401(k) Plan.

Under the Non-Qualified Savings Plan, if you reach the IRS total contributions or compensation limits before your last paycheck of the calendar year, you can still receive the full amount of company contributions for which you are eligible. Any company contributions that exceed the IRS limit amount would be deposited into your Non-Qualified Savings Plan account.

Spending accounts are optional benefits that enable you to save money on taxes while paying for eligible expenses.

You can contribute to the Health Care FSA, and then withdraw those contributions to reimburse health care eligible expenses. FSA contributions are deducted pre-tax on a biweekly basis and can reduce your taxable income, thereby saving you money. (The amount you choose to contribute will be deducted from your paycheck in equal installments over the calendar year.)

You can contribute to the Dependent Care FSA, and then withdraw those contributions to reimburse day care eligible expenses. FSA contributions are deducted pre-tax on a biweekly basis and can reduce your taxable income, thereby saving you money. (The amount you choose to contribute will be deducted from your paycheck in equal installments over the calendar year.)

Transit and parking benefits are offered through Fidelity. You can set aside tax-free money for each benefit, up to the IRS limit of $325 each month through December 31, 2025.

Transit benefits include fares such as tickets, passes, tokens and vouchers for riding buses, trains, etc.

The parking benefit covers fees at or near the workplace or at a location from which you commute to work via mass transit or a carpool.

Continued education in a work-related field enables you to enhance your skills and advance your career, while contributing to the company’s success. Organon’s educational assistance program is administered by Bright Horizons. You also can access discounted tutoring and college coaching for you and your family through Bright Horizons.

Educational Assistance

Fidelity Workplace Planning & Guidance Consultants offer financial planning services at no cost to Organon founders. They do not sell investment or insurance products, so you can rest assured the information you are receiving is unbiased.

Get help making decisions about Organon spending plan contributions, retirement savings and investments, health care or dependent care spending account contributions, managing debt and cash flow issues, and more.

We Use Cookies

We use cookies to improve your browsing experience on our website, to analyze our website traffic, and to understand where our visitors are coming from.

See our Privacy Policy (Link opens in a new tab)